As the fastest-growing major economy in a rapidly heating world, India’s electricity demand is growing fast. Since FY21, India’s electricity consumption has risen at approximately 9% per annum, compared to an average of 5% annually in the preceding decade. The Central Electricity Authority (CEA) had projected electricity demand to grow at a 6% CAGR between 2022 and 2030. However, recent trends suggest a strong likelihood of overshooting these estimates. Can India’s power sector keep up with this demand and transition to renewables at the same time?

What’s driving India’s electricity demand?

Besides economic growth and urbanisation, climate change-induced heat stress, marked by increasingly hotter summers, is one of the key factors driving electricity demand. Currently, industries, households, and agriculture comprise 33%, 28%, and 19% of total electricity use in India, respectively. Yet, household electricity demand has grown the fastest over the past decade. The summer of 2024 witnessed a 40-50% year-on-year growth in room air conditioner sales, driven by rising incomes and record-breaking temperatures. All-India peak demand crossed 250 GW on May 30, 2024, which was 6.3% higher than projections. In 2025, after recording the warmest-ever February in 125 years, India must now brace for extended heatwaves and a peak electricity demand growth of 9-10%.

In short, India’s electricity demand is growing fast and becoming more and more uncertain.

How has India met rising demand so far?

Since the early 2000s, power generation capacity has quadrupled to 460 GW, making India the third-largest electricity producer globally. Driven by the imperatives of clean energy transition, India’s power sector is undergoing a major shift with the rise of Renewable Energy (RE) technologies like solar and wind. In 2010, the Indian government set a target of 20 GW of RE by 2020, which was revised upwards in 2014 to 175 GW by 2022. In 2021, India further amped its target to achieve 500 GW of non-fossil fuel power capacity by 2030.

The government has continuously adopted several long-term and short-term measures to meet the spikes in demand. For instance, to manage the peak in 2022, it increased coal allocation to the power sector and prioritised its transportation through railways. It also directed imported coal-based power plants to operate at full capacity. States that have added substantive solar capacities utilised the surplus solar power to meet day peaks. Nights peaks continue to pose a challenge.

In many ways, 2024 was a landmark year — India added a record 28 GW of new RE capacity, bumping up the share of RE in the electricity mix to 13.5%. The share of coal in the capacity mix fell below half, though it still caters to 75% of power demand. India’s RE capacity now stands at 165 GW. Another 32 GW of RE is expected to be commissioned in 2025. In the following five years, India would need to add about 50 GW of RE every year to meet its 2030 goal.

Why should India further raise its clean energy ambitions?

Episodes of power shortages in the last two years amid rapid growth in demand pose an important question. How should India act and plan to meet its rising energy demand reliably and cost-effectively?

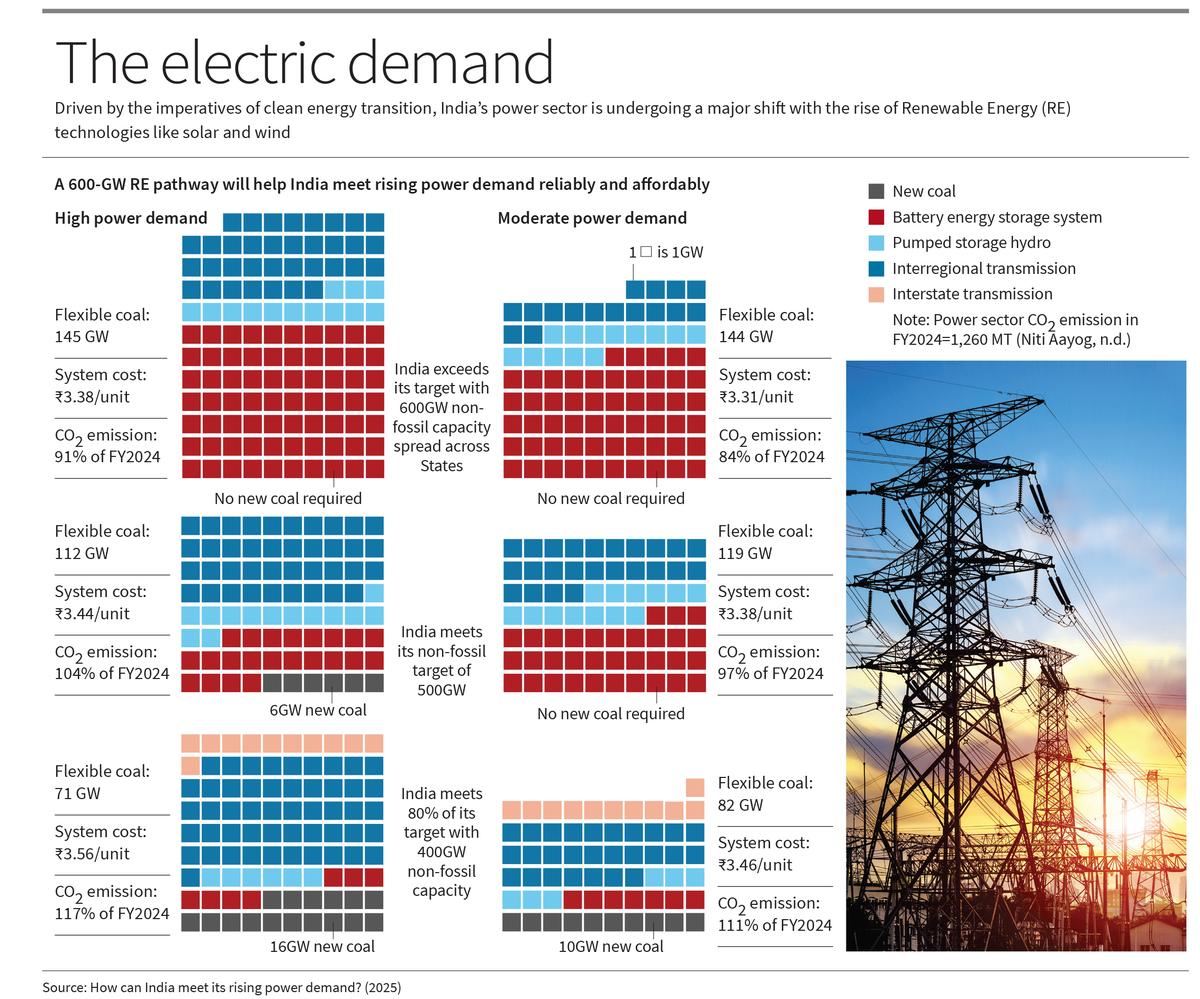

A new study by the Council on Energy, Environment and Water (CEEW) answers this question by simulating six scenarios of India’s power sector in 2030. CEEW found that failure to achieve 500 GW of clean energy capacity by 2030 will lead to power shortages and higher power costs, even if demand grows moderately. For instance, 0.26% of the demand will not be met if we achieve only 400 GW. Just this small percentage alone could impact the power supply to ~1 million households for 2.5 hours daily. States in northern India would be the worst affected because of network constraints.

If demand grows faster (at 6.4% CAGR between 2023 and 2030 instead of 5.8%) and the 500 GW target is achieved, India will still need additional generation capacity to avoid major power shortages. Here, India has two choices — add six GW of new coal (beyond the under-construction capacities now) or 100 GW of new RE capacity (beyond the stated 500 GW). The first choice will meet the demand, but the coal fleet will remain under high stress with a likelihood of increased downtime. This could result in sudden shortages and increased costs. The study finds that the latter choice of 100 GW of new RE capacity, distributed across States, is a better option.

How can India aim for 600 GW by 2030?

India must achieve 600 GW of clean energy by 2030 to keep pace with demand. This will help the country deliver reliable power at lower costs, saving up to ₹42,400 crore ($5 billion) in procurement costs in 2030 alone. It will also yield higher social and health benefits, with 1,00,000 new jobs (during 2025-2030) and up to 23% lower emission of air pollutants in 2030.

However, a 600 GW target would require 70 GW of RE addition annually until 2030 which may sound wishful. Several on-ground and grid-related challenges are already restricting the pace of RE deployment and have dwindled offtake interest among distribution companies. These include delays in securing suitable and conflict-free land, delays in the availability of transmission equipment, uncertainty around incentives for inter-State RE plants, and complexities of grid balancing. Given these challenges, relying on polluting coal power plants may seem more tenable. However, this approach would neither be affordable nor reliable. Historical trends show that coal projects take over seven years to start operations. In comparison, RE plants, being modular, could be deployed faster and supply cheaper electricity.

How can India add renewables faster?

Scaling to 600 GW is urgent and possible with the right market signals. Below are three key strategies to unlock the pace of RE deployment in India.

First, new RE projects should be spread across more Indian States. Currently, five Indian States house three-fourths of the total RE capacity. State-agnostic reverse bids and complete waiver of inter-State transmission system (ISTS) charges have crowded investments to a few regions, putting pressure on land. The government must work with more States, like Odisha, Madhya Pradesh, Bihar, Punjab, and Kerala, to create a conducive RE environment. For this purpose, the ISTS waiver should not be extended beyond June 2025, barring storage plants, which would also encourage distributed RE plants under the PM-KUSUM (Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan) and PM Surya Ghar Scheme.

Second, the Central and State governments must promote the co-location of wind and energy storage systems with existing and new solar projects. This would help effectively utilise land and transmission networks and support grid integration of renewables. CEEW’s study estimates that India will need 280 GWh of battery energy storage systems (BESS) and 100 GWh of pumped hydro storage to integrate 600 GW of RE by 2030. Here, we must prioritise BESS, which can be built within six months and is quickly becoming affordable.

Third, there is an urgent need for innovation in bidding and contract designs for faster RE procurement and RE availability in power exchanges. Several large solar and hybrid RE tenders, concluded in FY24 by intermediaries like the Solar Energy Corporation of India, did not generate offtake interest from States. The Union government must work with States to generate demand for RE procurement, devise suitable tender designs, and proactively resolve bottlenecks. Besides bilateral RE procurement, we must improve RE availability on our power exchanges. Here, the government could consider supporting a Contract-for-Difference pool that can de-risk merchant RE capacities.

India’s tryst with RE has seen many successes in the last decade. Hopefully, it can also achieve the unthinkable — double the share of clean energy in its generation mix from 25% to 50% by 2030.

Disha Agarwal is senior programme lead and Shalu Agrawal is Director of Programmes at CEEW. Views are personal.

Published – March 14, 2025 08:30 am IST