India’s wind energy market is poised for accelerated growth in 2025. | Photo Credit: REUTERS

India’s onshore wind sector fell short of expectations in 2024, but signs of strong recovery point to a record-breaking year ahead. Despite commissioning 3.4 GW of new capacity—the highest annual addition since 2017—the year ended below projections due to project cancellations caused by delays in grid connectivity and land acquisition, according to the Global Wind Energy Council (GWEC).

Nevertheless, the sector is rapidly regaining momentum. Backed by a robust mix of supportive policies, regulatory reforms, and infrastructure enhancements, India’s wind energy market is poised for accelerated growth in 2025. The anticipated expiry of the Inter-State Transmission System (ISTS) charge waiver in June is expected to accelerate installations.

Following a gradual rebound in 2024, India’s onshore wind market is projected to maintain strong growth in the coming years. Between 2025 and 2030, approximately 41 GW of new onshore wind capacity is expected to be added. This optimistic outlook is driven by several core developments.

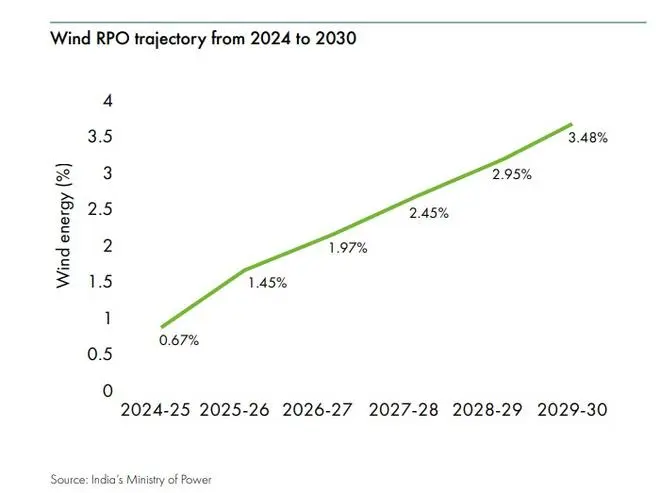

The government has set an ambitious annual auction target of 10 GW for onshore wind from 2023 through 2027. By the end of 2024, a total of 27.3 GW of projects had been awarded through standalone and hybrid auctions. Wind-specific Renewable Purchase Obligations (RPOs), valid through 2030, are fuelling demand, especially from the commercial and industrial segment.

Comprehensive transmission planning is also underway to support the integration of up to 48 GW of wind capacity by the end of the decade. At the same time, India’s local wind energy supply chain continues to strengthen, with new investments announced to bolster domestic manufacturing capabilities.

A significant area of focus for the sector is the repowering of ageing wind farms, particularly in the states of Tamil Nadu, Maharashtra, and Gujarat. These regions, which host mature wind markets, have substantial untapped potential. Replacing older turbines with modern, more efficient technology is expected to greatly enhance power output without requiring additional land.

India is also emerging as a global leader in workforce development for renewable energy. Initiatives such as the Vayumitra training programme, led by the National Institute of Wind Energy (NIWE), highlight the country’s efforts to build a skilled labour force for the wind sector. Since 1998, NIWE has trained thousands of professionals and worked in tandem with organisations like the Skills Council for Green Jobs and the National Skills Development Mission to support industry-aligned skill development.

These workforce initiatives are not only ensuring a consistent supply of skilled talent but are also reinforcing India’s status as a major hub for wind turbine manufacturing. With over 17 manufacturers exporting components to countries such as the USA, Brazil, Australia, and various European nations, India has strengthened its position in the sector.

On a global scale, India ranked among the top five markets for new wind installations in 2024, joining China, the United States, Germany, and Brazil. Both Germany and India moved up one position from the previous year. Together, these five countries accounted for 81% of all global wind additions, up one percentage point from 2023.

Published on April 25, 2025